Like businesses, not all banks are the same. But here are a few examples of banks who are ready to redefine banking with the use of Flexperto:

Nowadays, Customers expect interactions to be simple, intuitive, and seamlessly connected across physical and digital channels. The use of Digital advisory enables co-operative banks to excel in the customer dialogue even over distance, without neglecting the personal component of a meeting.

Online consulting, and video consulting in particular, is suitable for all areas of the banking journey. From initial contact after an in-person meeting, to loan application, portfolio management, construction financing, all the way to corporate clients’ advisory.

Thanks to Flexperto, branches and employees can also be supported online with dedicated experts and trainers.

Flexperto is one of the first software providers to specialize in online and video consulting for financial companies. With the Flexperto Communication Cloud, the complete customer dialogue is covered: from scheduling meetings, having a conversation over voice or video, intuitively see and edit document together, to the conclusion of contracts via e-signature.

That’s digital banking advisory : from A to Z.See how leading financial companies use Flexperto

Conversational banking is here: with the increasing usage of mobiles, Messaging is becoming an increasingly popular customer touchpoint. Hence, Cooperative Banks should transition to a customer communication over WhatsApp & Co. – without neglecting compliance matters.

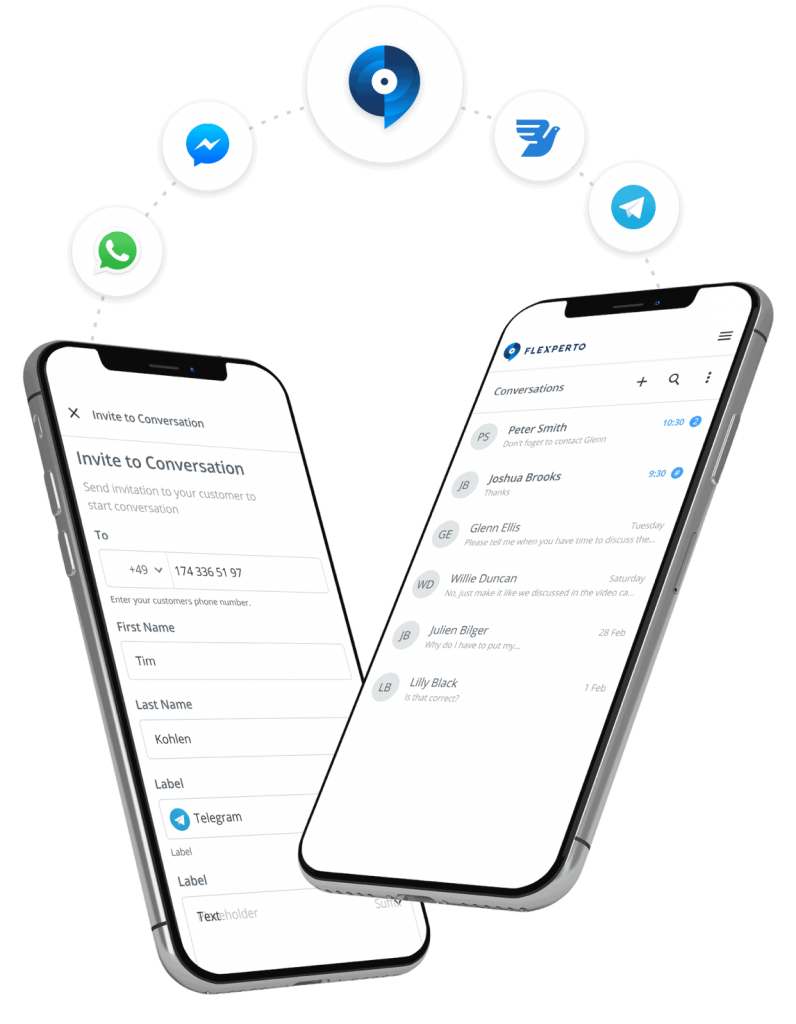

While communication via instant messaging is constantly increasing, the possibilities for using instant messaging in the banking sector are also extensive: from short enquiries, appointment confirmation and reminders, to status updates on loans applications or the conclusion of policies via WhatsApp, text message or Telegram.

Thanks to the Secured Messenger bank agents can be at their customer’s disposal at all times. Within the Secured Messenger, all common messenger channels can be routed into a single communication thread. This enables both agents and employees in the office, central customer service, etc. to communicate with customers securely and in compliance with data protection regulations. All conversations can further be stored within the existing CRM system.

By collaborating with highly regulated industries for the past eight years, Flexperto has built relationships with compliance regulators and departments of over 40 leading insurance and banks. We can showcase both experience and vast knowledge on legal requirements within the fields we operate in and are continuously running compliance workshops to keep up with fast-evolving compliance landscapes.

Beside complying with MiFID II, BaFin and GDPR, Flexperto can be integrated within Fiducia GAD infrastructure.

ROI

Enable cross-selling and up-selling potential of 30% from online and B & C customers by being available to your customers regardless of your location and by offering meaningful conversations all throughout their banking journey. This results in more clients being engaged and hence, more revenue.

Gain instant access to new customer collaboration tools such as scheduling, e-signature, or screensaring and improve the efficiency of your workforce. Thanks to our CRM integrations the entire dialogue is documented. In addition, a video session takes 15% less time on average than a physical meeting, which means time can be reinvested in more meetings with customers.

Generation Y & Z do not only want to be advised in-branch, but digitally as well. While the race of digital banks is “on”, a key differentiator between Cooperative Banks and new digital only players rely on the personal advice given to the client. Personal contact is also important to these target groups. Not providing the modern experiences customers want can benefit to competition filling those gaps or your target group churn to digital only banks.

In a world of ever-increasing mobility, customers are changing their place of residence more often. Flexperto enables bank agents to maintain relationships with long-distance customers, so that they can continue to be support them even away from home.

Enable visual communication and guide customers in real-time to provide help with visual guidance. Guide customers through a web-formular via co-browsing or show a new investment opportunity on your screen via screen sharing.